Enterprise Advantage app is available on the Google Play and App Stores

get the appDear Valued Customer,

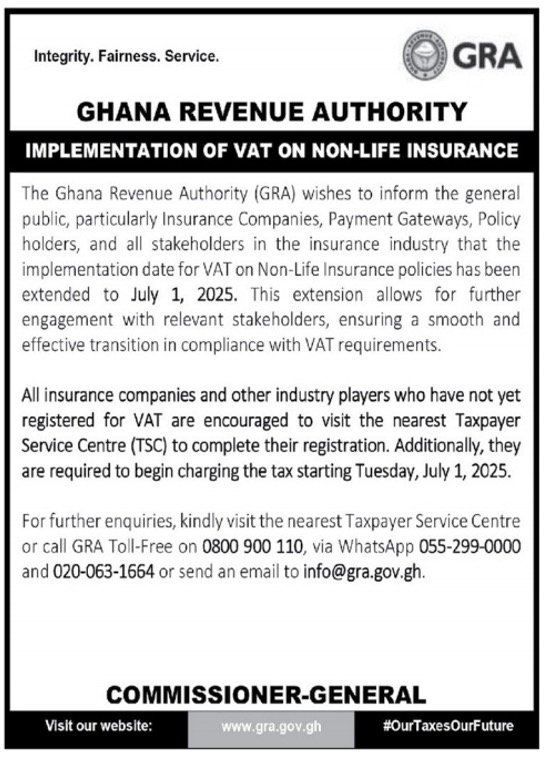

Effective 1st July 2025, all non-life insurance services offered by Enterprise Insurance Ltd—excluding motor insurance and bonds—will be subject to a Value Added Tax (VAT) rate of 15% and total levies of 6%, in accordance with the Value Added Tax (Amendment) Act, 2023 (Act 1107). This applies to both new and existing policies.

VAT Breakdown:

The applicable levies and tax rates are as follows:

Example of Premium Computation with VAT

For a premium of GHS 100:

1. Add levies before VAT:

o NHIL (2.5%): GHS 2.50

o GETFund (2.5%): GHS 2.50

o CHRL (1%): GHS 1.00

Subtotal: GHS 106.00

2. Apply VAT (15%) on GHS 106 = GHS 15.90

Total Tax = GHS 6 (levies) + GHS 15.90 (VAT) = GHS 21.90

Therefore, Effective Tax Rate = 21.9%

Enterprise Insurance remains committed to transparency and to empowering our customers with the information they need to make confident and informed insurance decisions.

For further inquiries, please contact the Enterprise Insurance customer service team on 0302634777 or email us on customerservice.insurance@myenterprisegroup.io